Iowa banker says SBA red tape, liens unfair to disaster victims

September 18th, 2024 by Ric Hanson

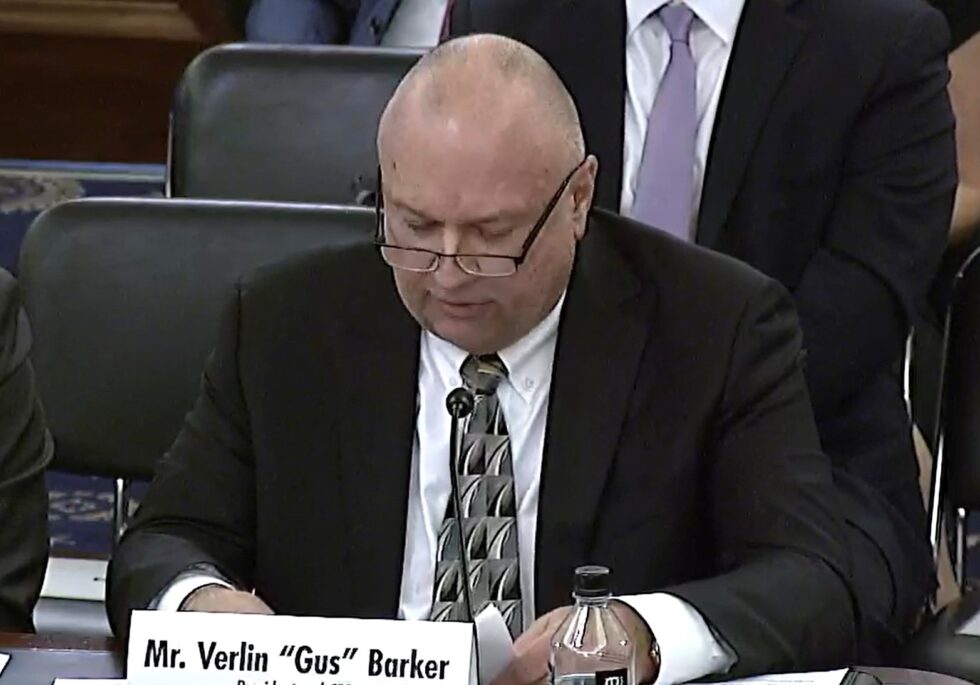

(Radio Iowa) – A northwest Iowa banker says there’s too much red tape in federal disaster recovery programs. Gus Barker is president and C-E-O of First Community Bank in Newell. “Disaster victims are in no position to complete that excessive paperwork,” Barker says. Barker testified this (Wednesday) afternoon at a hearing of the U-S Senate Small Business Committee. He told senators about helping a customer, who was a victim of the historic floods of 1993, complete a Small Business Administration loan application.

“We could not have completed that application without the support of the local SBA office,” Barker said. “Regretably since that time, SBA scaled back its presence in Iowa and applications are now approved in San Francisco, a distance which makes coordination much more challenging.” Barker says direct lending from the Small Business Administration and other federal programs have played a key role in the survival of disaster stricken businesses and he’s urging the agency to make changes.

Gus Barker, president and CEO of First Community Bank in Newell, testifies at Washington, D.C. hearing.

“SBA is known to file liens far in excess of the loan amount to secure their mortgages. These liens tie up their collateral and prevent a community bank from helping the borrower in any way in the future,” Barker says. “SBA should be willing to subordinate their loans in the way that USDA has, for example.” Barker says disaster victims should also be able to package federal benefits offered by different agencies — like a S-B-A loan and a grant from the Federal Emergency Management Agency.

“Neither of which is adequate in itself in the rebuilding,” Barker says. “Today, a victim must choose one or the other. It’s too much to ask for disaster victims to learn the details of those programs and make an informed judgment of what to do.”

Barker, who has worked in his family-owned bank for 47 years, is on the Independent Community Bankers of America board of directors.