Bill would eliminate Iowa individual income tax

March 15th, 2023 by Ric Hanson

(Radio Iowa) – A Senate committee has approved a bill that would gradually eliminate the state income tax — if state tax revenues continue to grow. Senator Dan Dawson, a Republican from Council Bluffs, is chairman of the Senate Ways and Means Committee. “It is a continuation of modernization and competitiveness of our tax code here in Iowa,” Dawson said, “…not only for families to come here, to stay here but as well as for businesses to recognize that Iowa has a very competitive and compelling footprint here to locate.”

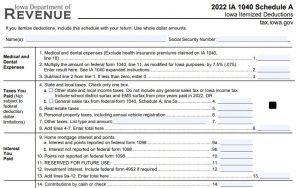

Governor Reynolds signed a bill into law last year that will gradually reduce the state income tax to 3.99%. This new bill would cut the rate to 2.5% by 2028 and it would reduce Iowa’s corporate income tax from 5.5% to 4.9%. “We can’t rest on our laurels and think what we accomplished is all we can do,” Dawson said.

The five Democrats on the committee voted against the move. Senator Herman Quirmbach of Ames said getting rid of the state income tax will lead to cuts in state services. “The state income tax is half the state revenue,” Quirmbach said. “So how are we going to pay our bills?”

According to Quirmbach, 56% of the state budget is spent on education and getting rid of half of state tax revenue would mean the state universities would dramatically raise tuition and class sizes would double in K-12 schools.

“I understand the short term benefit, pelvically, from saying: ‘Oh, whoopie, we’re going to cut taxes,’” Quirmbach said. “I don’t like paying taxes any more than anybody else, but I know that my constituents value education. They want their K-12 schools to be first in the nation again, which they aren’t right now.”

Dawson said cuts won’t be necessary if the state budget and tax cuts are “managed appropriately.” He said under the bill, state income taxes are only reduced if there’s money in the Taxpayer Relief Fund. State tax revenue that’s above expectations or left unspent at the end of a budgeting year is deposited in that fund.

Republican lawmakers are also developing a plan to reduce property taxes. Governor Reynolds has said she’s left drafting of property tax cuts up to GOP lawmakers because her priority this year was state-funded education savings accounts for private school expenses — something she’s already approved.