Atlantic City Council to act on temporary street closure; setting date for tax hearing

February 3rd, 2020 by Ric Hanson

The Atlantic City Council will meet in a regular session 5:30-p.m. Wednesday (Feb. 5th), in their chambers at City Hall. On their agenda is action on an Order to close select streets on June 13th, from 7-a.m. To 11:30-p.m., for the SHIFT ATL Block party. The affected streets include: Chestnut, from 7th to 6th, and 6th Street from Chestnut to Poplar. The event will include a beer garden, live music and smoke-off competition, with the proceeds benefiting SHIFT ATL accomplish their Atlantic revitalization initiatives.

The Council will also hear a report from Parks and Recreation Department Director Bryant Rasmussen and key accomplishments of the department in 2019, along with outlining goals for 2020. They will then act on a Resolution setting Feb. 19th at the date for a Public Hearing on approving “Fiscal Year 2021 Maximum Property Tax Dollars.”

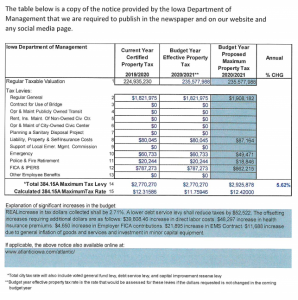

City Administrator John Lund says the Iowa Department of Management requires the City of publish in the newspaper and the City’s website as well as any social media page, the Maximum Tax Levy & Rate. Lund says “While it appears [in looking at the numbers] the City is going wild, asking for a year-to-year increase of 5.62%…the devil is in the details.” He says “The total tax rate will also include voted general fund levy, debt service levy, and capital improvement reserve levy.”

The City’s debt service levy of $4.23, according to Lund, is completely hidden in the published notice. It accounts for slightly more than $1.07-million the City will tax, as compared to the more than $1.04-million in the previous year. Lund says “On the property tax statements, the City will show an increase of 2.71%, NOT the 4.67% shown on the public notice.” “Over the long term,” he says, “the City is expected to see less and less in dollar increases from property taxes due to the structural limits outlined in the State Code, and the declining taxable value realized from the multi-residential rollback.”

Lund said also, that while 2.71% is the increase in dollars generated, it will not reflect the impact on the property taxes levied against individual properties. “There is no way to know,” he says, “what the impact will be in year-to-year impact on taxpayers. However, when other authorities set their levies, a taxpayer can calculate the changes in their property taxes using the formula:

(Assessed Value) x (Property Class Rollback = Taxable Value

(Taxable Value) x (Combined Levy of all Taxing Authorities) /1,000 = (Gross Taxes Due)

(Gross Taxes Due) – (Applicable Tax Credits) = (Net Taxes Due).

Lund said also, he’s forecast a less than one-percent increase in the FY 2022 budget. After the Council sets the date for a public hearing on the FY21 Maximum Property Tax Dollars, they will act on a Resolution setting the date for a Public Hearing “On a proposal to enter into a General Obligation Solid Waste Management Loan Agreement and to Borrow Money [in a principal amount] not to exceed $90,000.

The Cass County Landfill has instituted a per-capita fee of $12 per resident, to be assessed annually. The amount the City pays is $85,344, payable in four equal payments over the course of the fiscal year. The final action item on the Council’s agenda, is a Resolution “Establishing the Allocation of Revenues from the City of Marne through Compensation for Specified Activities” (with regard to time and work performed by the Atlantic City Clerk and her Assistant). Marne pays Atlantic $5,000 per year for those services. The Resolution would set a schedule for how those funds are dispersed.